Offshore Wealth Management Solutions: Crafting Your Financial Legacy Strategically

Wiki Article

The Advantages of Offshore Riches Administration for International Investors

Offshore wealth management has actually become an increasingly prominent selection for international capitalists looking for to optimize their economic techniques. Offshore wealth monitoring supplies diversity chances, permitting financiers to spread their financial investments across different economic climates and sectors. By welcoming offshore wealth management, global investors can tactically browse the worldwide financial landscape and optimize their economic possibility.Tax Optimization

How can international financiers maximize their taxes via offshore wealth monitoring?Offshore riches monitoring offers global financiers a range of choices to enhance their taxes. By using offshore accounts and frameworks, investors can take benefit of numerous tax benefits and strategies.

One more method international financiers can enhance their taxes is via tax obligation planning and possession defense. Offshore wealth administration permits capitalists to structure their possessions in a method that minimizes tax obligation liabilities and shields them from prospective lawful or economic threats. By diversifying their holdings across various jurisdictions, capitalists can decrease their exposure to any one country's tax obligation program or legal system.

Improved Privacy

By establishing offshore accounts, capitalists can profit from the strict financial institution secrecy regulations that exist in many overseas jurisdictions. These laws forbid banks and banks from revealing any kind of customer information without their specific consent. This level of personal privacy defense permits investors to keep their monetary events very discreet and away from the scrutiny of tax authorities, creditors, and even member of the family.

Furthermore, overseas wealth monitoring gives an additional layer of privacy via the use of counts on and company structures. Depends on provide a high level of privacy as the possession of possessions is transferred to the trust fund, making it testing for outsiders to trace the best recipient. Company frameworks such as offshore companies or foundations can be made use of to guarantee anonymity and secure the identification of the investor.

Access to International Markets

Worldwide financiers access to global markets with overseas wide range management. Offshore wide range monitoring offers capitalists with the chance to expand their profiles and tap into a larger series of investment chances around the world. By utilizing offshore frameworks, capitalists can purchase different territories, money, and this website asset classes, allowing them to spread their danger and possibly boost their returns.

One of the crucial advantages of offshore wealth administration is the capability to accessibility arising markets. These markets provide high growth possibility and can offer investors with one-of-a-kind investment possibilities that may not be available in their home countries. Offshore wealth management allows investors to make the most of these chances and take part in the development of economies in nations like China, India, Brazil, and numerous others.

In addition, overseas wide range administration can provide investors with access to specialized markets and financial investment products. Some overseas territories offer specific financial investment vehicles, such as hedge funds, personal equity funds, and property investment trusts (REITs), which might not be available in their home nations. These specialized investment choices can offer financiers with additional diversity and possibly higher returns.

Possession Protection

One of the essential advantages of offshore wealth management is the improved possession protection it uses to international financiers. Offshore territories give a private and safe and secure environment for financiers to secure their properties from possible threats and unpredictabilities. By diversifying their investments across various jurisdictions, financiers can properly protect their wide range from political instability, recessions, and lawful unpredictabilities in their home countries.Offshore wealth administration permits investors to hold their properties in trusts, structures, or corporate structures, giving an added layer of defense. In addition, overseas territories typically have robust lawful frameworks that shield the personal privacy and discretion of financiers.

Furthermore, overseas wide range administration permits capitalists to make use of worldwide laws and treaties that use favorable tax advantages and asset defense provisions. By tactically structuring their financial investments, capitalists can decrease their tax obligations and secure their assets from extreme taxation.

Diversification Opportunities

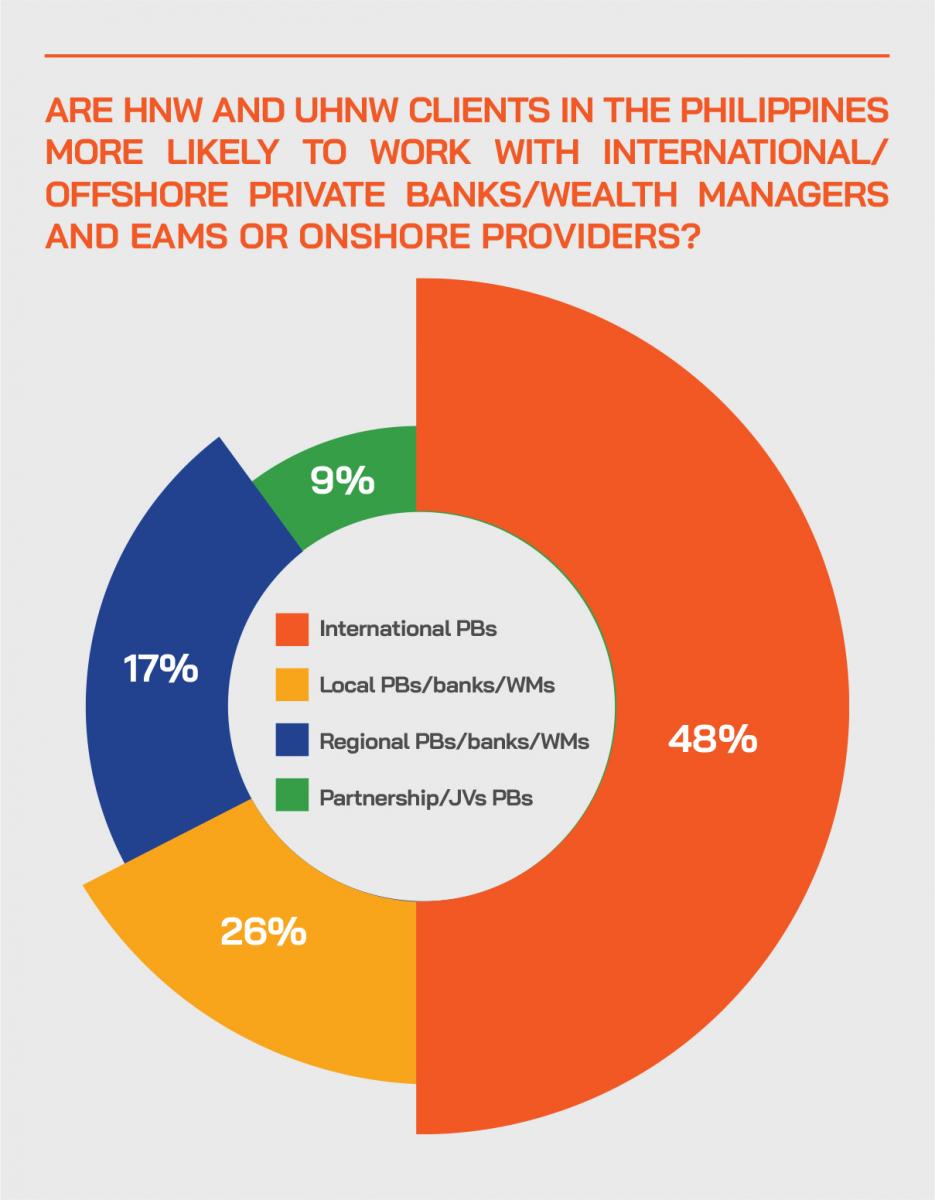

Financiers have access to a variety of diversification possibilities with overseas wide range management. Diversification is a fundamental concept of investment, aimed at minimizing threat by spreading out investments across different property classes, sectors, and geographical areas. Offshore wealth management supplies global investors with a considerable array of financial investment alternatives to expand their profiles efficiently.Among the main benefits of offshore wide range management for diversification is the accessibility to international markets. Offshore economic facilities provide investors the capability to purchase a wide variety More about the author of international markets that might my link not be available or available in their home countries. This enables investors to capitalize on diverse economies, markets, and currencies, decreasing their direct exposure to any type of single market.

Furthermore, offshore wealth management supplies access to alternative investments. These can include hedge funds, personal equity, realty, and assets, to name a few. Alternate investments typically have low correlation with traditional property classes such as bonds and stocks, making them useful tools for diversification.

Additionally, overseas riches administration enables financiers to make use of tax performance - offshore wealth management. Various territories provide differing tax benefits, including tax-free or low-tax atmospheres. By structuring investments offshore, capitalists can enhance their tax liabilities, freeing up much more resources for diversification functions

Final Thought

In final thought, offshore wide range administration supplies countless advantages for international investors. Offshore wide range management offers diversity possibilities, enabling financiers to spread their investments across various markets and property classes.Offshore wide range management uses worldwide investors an array of options to maximize their taxes. Offshore riches monitoring enables investors to structure their assets in a means that lessens tax obligation liabilities and protects them from prospective legal or monetary dangers.By establishing overseas accounts, investors can profit from the rigorous bank privacy legislations that exist in lots of offshore jurisdictions.Worldwide investors obtain access to international markets via overseas wide range monitoring.Additionally, offshore riches management enables investors to take advantage of tax performance.

Report this wiki page